selling a car in florida taxes

You will pay less sales tax when you trade in a car at the same time as buying a new one. For counties offering fast title expedited service a 10 fee will apply in addition to the standard title fees.

Florida Retailers Plead For Sales Tax Collections On E Commerce

The cost is 5 as of 2019 and is valid for 10-days.

. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using. If you buy a car for 30000 you would typically owe a six percent sales tax which comes. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

You would not have to report this to the IRS. The buyer must pay Florida sales tax when purchasing the temporary tag. No discretionary sales surtax is due.

Step 1 -- Transfer the Title. Florida Vehicle Sales Tax Fees Calculator There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets Car. Value of trade does reduces the sales price of the new car for sales tax purposes.

FULLY TAXABLE CAR SALES. You can sell a car without tax. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

All such certificates issued in Florida after February 1983. Sale of 20000 motor vehicle to a. The recipient has two ways to transfer the FL car title when gifted.

If youre selling a car for less than you paid for it you will not have to pay taxes on it. One way to do it is to go to their local FL DMV with. Calculate car sales tax example.

A private seller does not have the responsibility to collect sales tax from the purchasing party unless of course your income is derived from. Any car sale that does not meet any of the exceptions above. However the seller must sign over the.

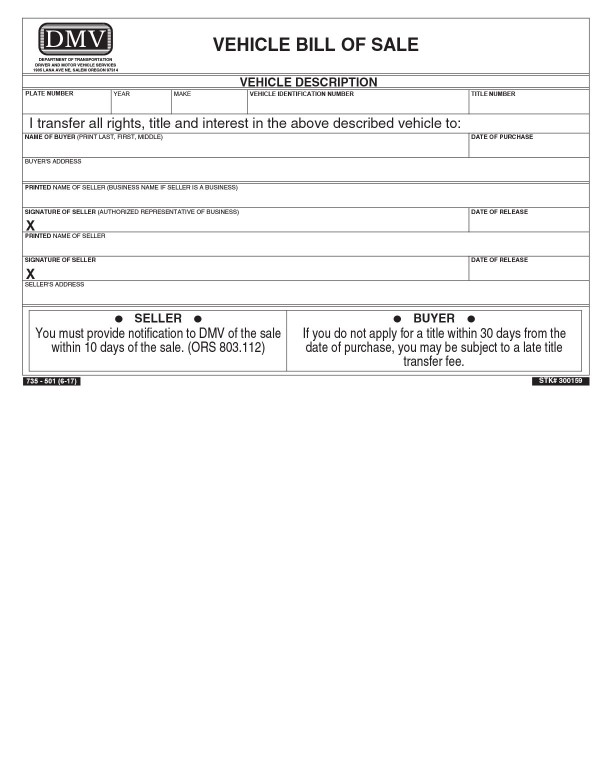

Motor vehicles is 7. Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle. To sell your car in Florida youll complete the Transfer of Title by Seller section on the front of your state car title certificate.

Whenever you sell a car in Florida filing form 82050 is a must. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in. To obtain this youll need to head to the nearest DMV office with proof of Florida insurance.

It takes your name off the car youve sold and ensures you are not liable for anything that should occur once the new. This is because you did not actually generate any income from the sale of the vehicle. If the title is held electronically the seller and buyer must visit a motor vehicle service.

To be tax-exempt the application for title or the transfer of license or registration must be accompanied by a sworn statement that includes a description of the motor vehicle the name. The gift recipient needs to complete a title transfer.

Tax Department Of Motor Vehicles

Florida Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Cars And Vehicles In Florida

What Is Florida Sales Tax On Cars

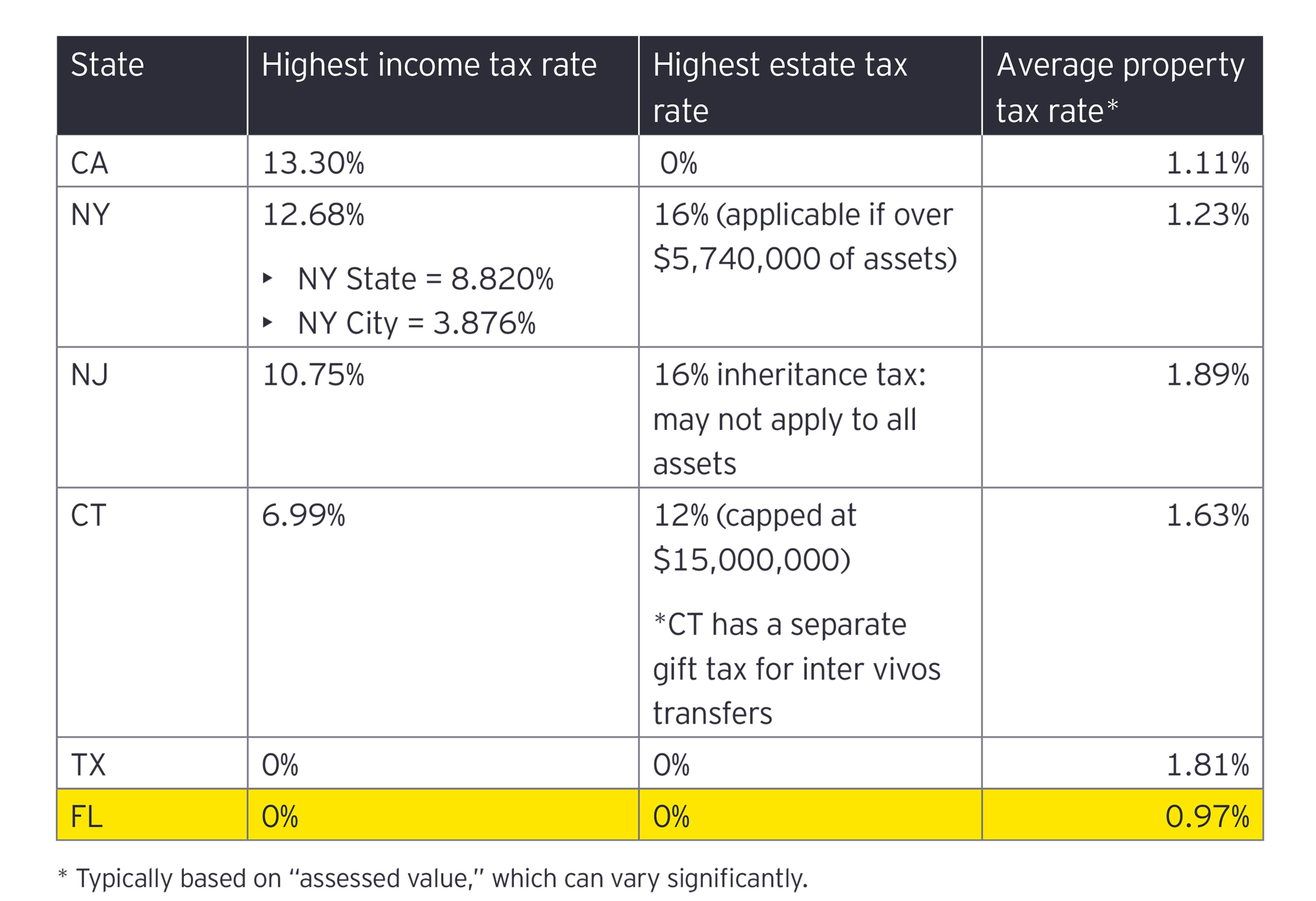

Tax Considerations When Moving To Florida Ey Us

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Tax Issues In Selling A Business Vehicle

Florida Car Sales Tax Everything You Need To Know

Florida Sales Tax Small Business Guide Truic

Selling A Car In Florida A Former Dealers Advice

Vehicle Sales Purchases Orange County Tax Collector

Florida Sales Tax For Nonresident Car Purchases 2020

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

How Do State And Local Sales Taxes Work Tax Policy Center